Question:

This is the first year we will be offering a Health Savings Account (HSA) plan option to our employees (starting January 1, 2023). We also offer a PPO and a health flexible spending account (FSA). We have been educating our employees on the rules regarding when they are eligible (or ineligible) to contribute to an HSA, but I’m finding conflicting information about how the FSA affects such eligibility.

I’m particularly concerned about employees who had the FSA last year and are moving to the HSA this year. We offer a grace period (until March 15th of the following year) for employees to spend amounts contributed to their FSA in the prior year. I have read conflicting information about whether having the ability to use their FSA from last year during the grace period will disqualify employees from contributing to an HSA this year. Can you help me (and my employees) understand?

Answer:

In order to contribute to an HSA, an individual must: a) be enrolled in a high deductible health plan (HDHP) that meets certain requirements; and b) not have any “disqualifying coverage.” For this purpose, “disqualifying coverage” includes such things as:

- Other group health coverage that is not HSA-eligible (such as if the employee is also covered under a spouse’s or parent’s plan);

- Medicare, Medicaid, Tricare, or other individual health policy;

- Pre-tax arrangements that can be used to pay medical expenses that would otherwise go toward the deductible (such as a General Purpose FSA* or Health Reimbursement Arrangement); and

- Any other benefit or plan that would help the individual pay for medical care before the deductible is met (such as some onsite clinics, EAPs, or telehealth).

Whether and when an FSA will disqualify an individual from contributing to an HSA is complicated, but here are some things to keep in mind:

- In general, having money in a General Purpose FSA will disqualify an individual from contributing to an HSA. This includes money left in an FSA during a grace period.

- Limited Purpose FSAs (which cover dental, vision and other expenses not covered by the health plan) are not considered disqualifying coverage.

- An FSA belonging to another family member, such as a spouse or parent, is disqualifying coverage if it can be used to pay the employee’s medical expenses.

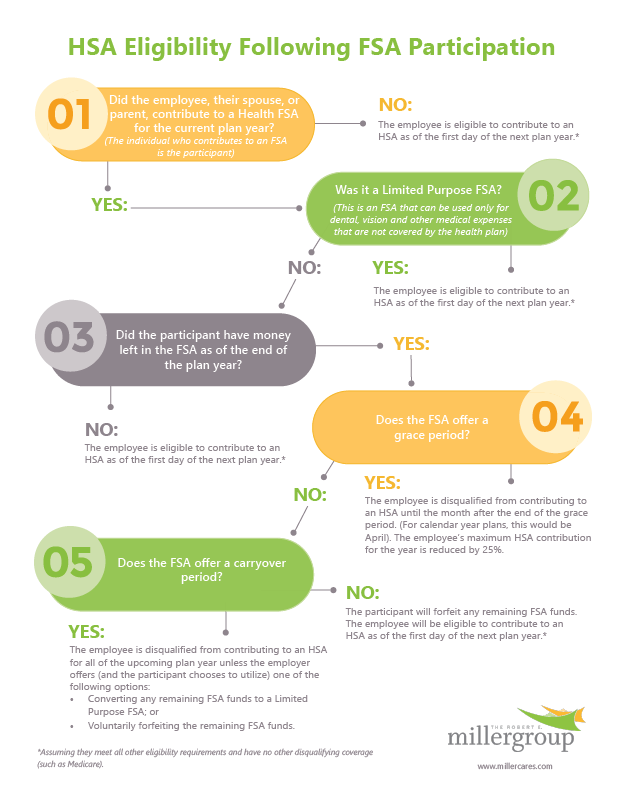

Transitioning from an FSA to an HSA is definitely tricky! Check out our infographic to help walk you through the issues.