Strong Workers' Compensation Market Sets the Stage for 2026

October 16, 2025

Discover why workers' compensation rates will be stable moving into 2026 and what you can do to further reduce premiums.

Discover why workers' compensation rates will be stable moving into 2026 and what you can do to further reduce premiums.

The insurance market has not been kind to most commercial insurance buyers over the last five years, with auto and umbrella coverages leading the charge in rate increases. The one line of coverage brokers and clients have counted on to help offset premium increases has been workers’ compensation.

Workers’ compensation has been profitable for most insurance carriers, with the net combined loss ratio for 2023 and 2024 at 86%. A combined ratio below 100% indicates that the company is making a profit, while a ratio above 100% suggests the company is paying out more in claims and expenses than it is receiving in premiums.

A few factors have led to continued improvement for workers’ compensation lines.

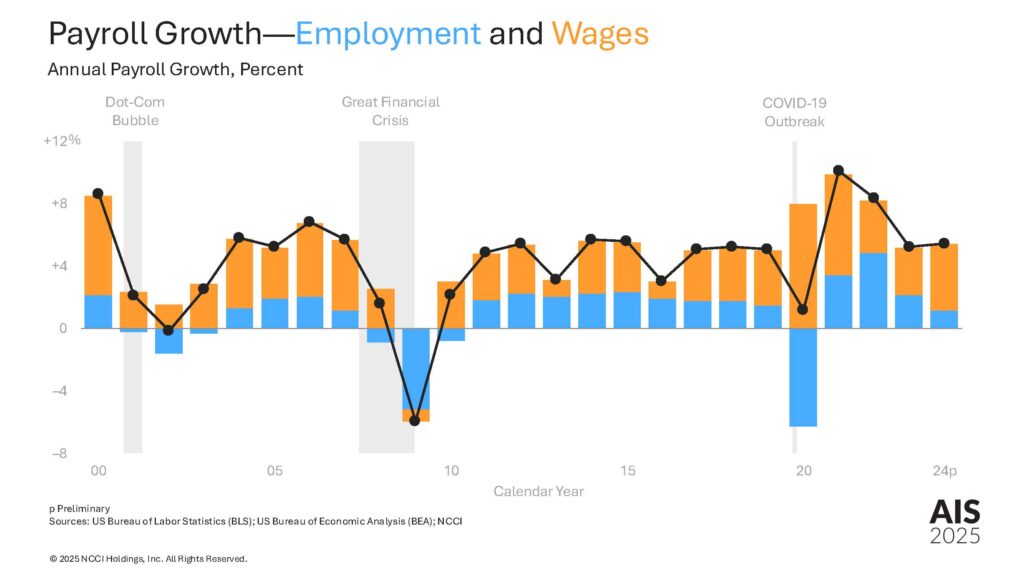

According to NCCI, we have seen annual payroll growth every year since 2000 outside of three major economic events that happened during that time frame (the Dot-Com Bubble in 2001, the Great Financial Crisis in 2008-09, and COVID-19 in 2020).

Additionally, many employers have adopted more robust return-to-work programs, helping injured employees re-enter the workforce faster and reducing time-loss claims. This has helped the lost-time claim frequency continue to decrease over the last 10 years.

What also helps is that lost-time severity has not seen a big spike while it’s been slowly increasing over the last 10 years. When you compare this to the large legal verdicts associated with general liability and automobile claims, it helps drive home why insurance carriers are excited to write this coverage.

Because we expect 2025 to be another profitable year for workers’ comp carriers, we don’t anticipate rate increases for clients in most states in 2026. That said, some states, such as California and Washington, have filed for rate increases due to loss activity.

Even with the positive renewal outlook, there are things you can focus on to help your company keep premiums as low as possible.

In conclusion, as we move into 2026, workers’ comp continues to perform well while other lines of coverage struggle. Rate filings suggest continued stability, and barring major legislative changes or economic shocks, profitability is expected to hold.

Staying engaged with your broker, understanding your mod, and investing in safety and claims management will ensure you’re positioned to benefit in this current marketplace.

If you’re looking for guidance on workers’ compensation, understanding your experience mod factor, or seeking strategies to manage your costs effectively, reach out to The Miller Group team.